Turning $4,750 Into $90,000 – The Power of Real Estate Investing

When I was twenty-three, I got it in my head that I wanted to buy a house. My first house, a property, a homestead. In between scanning listings and calculating principal and interest rates, I frequently asked myself, “What am I thinking!?” The idea seemed daunting and overwhelming, but I couldn’t get the idea out of my head. Despite the many things I didn’t know, I did know a few that were compelling enough to take the leap of faith:

- As much as I loved the city of Ann Arbor and home to my alma mater, I was beginning to feel old as new waves of students began to inundate the libraries, bars and restaurants I once called mine. I needed a change of scenery with more age appropriate peers. I was going to have to live somewhere and pay something.

- If I could be the ‘landlord’ and have others pay me, I could ideally, at least break even.

- I would hopefully build equity, or at least maintain it.

- In the event that I had to move, I could likely rent out the place and break even, or better.

While uncertainty loomed over my head, I felt I was armed with a reasonable game-plan that would take care of the worse case scenario. So, I was compelled to dig deeper.

It’s true that it’s all about who you know, but this isn’t necessarily about their clout or power, rather more about making the right connections and helping to steer you in the right direction. Fortunately for me, I knew a family friend in real estate that was able to help me navigate some of the nuances of taking out a loan and buying real estate. Soon I collected a few key pieces of priceless information that would inevitably get me across the finish line of making my first purchase. Good investors don’t necessarily have a higher risk tolerance compared to the average investor, simply put they are better at mitigating the downside in the event that their bet doesn’t play out as expected. In hind sight, I followed a similar path, but more because of my fear of loss. This is what I focused on:

1) As a first-time home-buyer, your are eligible for a FHA loan. Why does this matter? Well, because FHA loans stipulate that you only need to make a down payment of 3.5% (as opposed to the conventional 20% down payment). Effectively it’s an incentive to stimulate home buying and allow people to purchase homes. Banks love them because the loans are backed by the government and we love them because they allow you to leverage your money.

2) During this period there was a first-time homebuyer tax credit in effect, up to $8,000 depending on the purchase amount. In my mind, this was insurance. If housing prices continued to fall, I would at least have an $8,000 stop-gap.

Now as with anything good there was a minor catch. With a FHA loan you have to pay what’s called private mortgage insurance, or PMI. But in the grand scheme of things this is only a small percentage of your payment; typically less than 0.1% (that’s right, 0.1%). This is paid due to the small amount of equity investment on behalf of the buyer, 3.5% to be exact. Once a threshold of 20% is reached (a standard down payment for a conventional loan) the PMI or insurance is removed. Many people that I’ve talked to on the topic of PMI seem to fret about it a little too much. In my mind, the leverage of capital that this type of mortgage structure allows you massively outweighs the added cost of PMI. Additionally, you have multiple outs in order to reduce the cost;

a) Either continue to pay down the mortgage over time to establish equity, or

b) Establish equity through renovation or otherwise in order to achieve a 20%+ equity to loan ratio

While 3.5% doesn’t seem like much, at the time I was just a year or two out of college. Though working a full time job, 3.5% on a $100,000 would have been $3,500; not much less than my entire savings at that point in time. Comfortable wasn’t quite how I was feeling about the situation.

In my case, this is approximately how the numbers worked out:

- Purchase Price:$138,000

- Down Payment: $4,725

- Closing Costs: (Assume seller concessions or roll fees into the mortgage.)

- Mortgage (5% APR): $133,275

- Taxes: $2,500/yr.

- PMI: $900/yr.

- Insurance: $500/yr.

With a 30-yr amortized mortgage, your final payment after taxes and insurance would be approximately: $1024.

Coming from my shared two-bedroom apartment in Ann Arbor at $800/mo, I was astonished. Here I was getting a house with 3 bedrooms, 1 bathroom, a 2 car garage, and a back yard for nearly the same amount of money.

It gets better… One of the key benefits to owning property are the tax benefits; the government rewards home-ownership, perhaps one of the many reasons for the crash of 2008/9. However, as long as you’re not buying a $300,000 house on a $50k salary, you’ll be just fine. Tax law states that you don’t pay taxes on income spent on interest payments; furthermore, depreciation is also considered a tax deduction. Now, if you’re new to the mechanics of amortized loans, basically your payments are broken into principal and interest in such as way that 70%-80% of you payment goes toward interest. Over the course of the loan more and more is paid towards principal. Why do this? Well, banks want their money sooner than later, while the payment remains the same to the customer.

The result of this is that you are able to deduct $5500-$6500 dollars off of your income during the initial years of your payments (based on the given example.) Factor in the depreciation deduction of approximately $3900 (based on a specific calculation) and you’ve just reduced your taxable income by nearly $8,000. The end result, a monthly savings of approximately $240, bringing your monthly payment down to about $784.

Now, if that weren’t enough, you also have to consider the benefit of the money that goes toward the principal payment on your house, also known as equity. As I mentioned before, very little goes toward principal early on, however, it’s not nothing! In the first few years, principal reduction would be around $160 monthly; this can be considered equity in your house, or an investment. The idea here is that you will be able to recoup this once you sell the house, assuming 2008 doesn’t happen again any time soon. With this in mind, your total year-end net cost is only about $622. Not bad for a 3 bedroom, 1 bath house in a great city.

To recap:

- House: $138,000

- Investment: $4,725

- Monthly payment (after taxes): $784

- Pride of owning your own home: Priceless

What important to note here is that I was effectively paying less than what I was paying in rent just a few months prior. Factor in the rent from the other two rooms and this deal was a home run!

My Evaluation Process

Real estate investing is a tricky thing, with little certainty. But then again what in life has true certainty, short of gravity. I was scared out of my mind initially when contemplating buying a house, but sticking to a process, using my resources, and learning as much as I could are what kept me in the game. In my experience, most successful outcomes are a result of process and resources. Processes can be learned or constructed and resources can be acquired or sought out. When I was in search of my house, I needed both. Initially, these were some the key things I looked for:

- Economic resilience: while I generally get mocked when I tell people I’m from Detroit, as with all cities, it has its bad areas and its good. At the time I knew I wasn’t leaving Michigan so I looked for metropolitan city that would be fun to live in (i.e. bars, restaurants, and other 20 somethings), had faired reasonably well through the 2008 crash, and was a hub for commerce, lifestyle, and working.

- Industries and academics: I looked for companies or industries in the area that would continue to support the area and would be insulated to economic downturn. In my case, this was mostly medical and academic facilities (e.g. Wayne State University, or the hub of hospitals in Detroit) in the area. I knew that this could potentially provide tenants as well as ensure a stable local economy. As it turned out, I ended up having two roommates that were in medicine.

- Speculation and anticipation: during college I lived and breathed the 2008 crash. I read the Wall Street journal nearly every day, studied the stock markets, and discussed the key issues in economics classes and amongst friends. Coming into 2010, I was feeling the floor of the market and felt reasonably confident that we were nearing a bottom. With the $8,000 insurance the government was offering for buying my first house, I felt comfortable taking the risk.

In the end, I had visited dozens of houses and finally landed in Royal Oak, Michigan which became my home for the following 4 years.

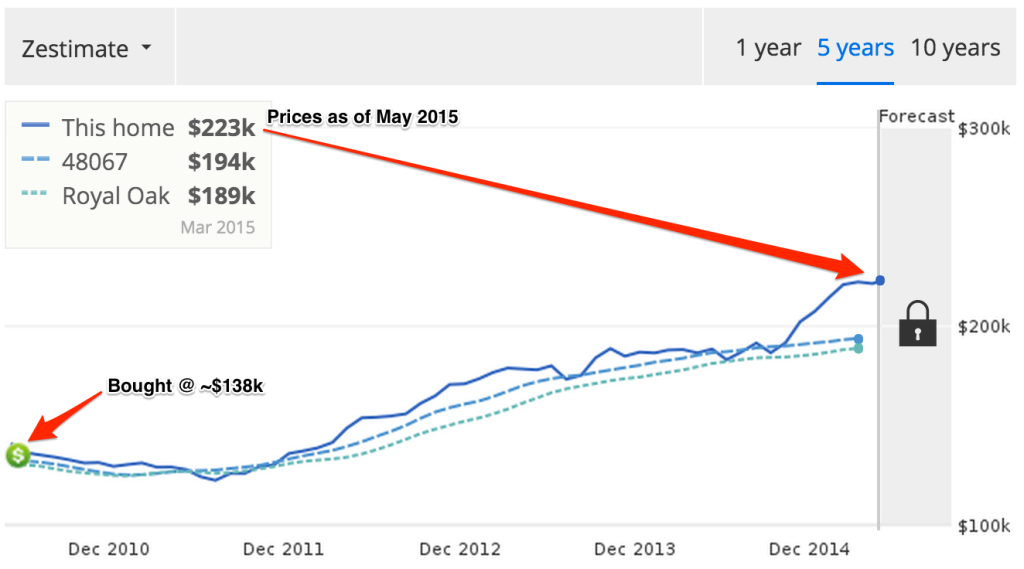

The Power of Appreciation

I bought my house in May 2010 for around $138,000. The market value as of May 2015 was approximately $220,000 as calculated by Zillow.com, which, by the way, I’ve found to be relatively accurate in my experience. Less the outstanding mortgage, that leaves about $90,000 in equity that I’ve accumulated over the 5 year period on my initial investment of $4,725. It’s important to note that the mortgage has been slowly paid off over the 5 years through principal and interest payments, but this is money that would have otherwise gone towards someone else’s mortgage, i.e… rent. Taking my $4,725 initial investment over the 5 years relative to the equity that I’ve built, the result is about a 380% annual return, or about $90,000 in net equity! No doubt I benefited from a depressed market and results like these aren’t easily found. Not to mention the sweat equity I put in over the years from updating the bathroom, renovating the master bedroom, and redoing the landscaping, custom-built fence included. The lesson I learned here is what it truly means to ‘build’ wealth. Wealth is a function of time and effort with a dash of luck.

Final Thoughts

“Reality is merely an illusion, albeit a very persistent one.”

– Albert Einstein

At 23, I was certainly a minority amongst my peers. I had no one to relate to, no one to validate my decisions, no one to tell me I was right or wrong. It was tough venturing out into the abyss, but looking back, it was well worth it. Certainly hind-sight is 20-20 and you can only connect the dots looking backward as Steve Jobs would say, but with the right guidance you can work to piece together the future, achieving the goals and dreams you set out for yourself. Generally, it’s the things you work for the hardest for that you value the most and it’s the things you do or learn yourself that you cherish most. Go beyond your comfort zone.

If you’re contemplating buying a house or some other comparable investment, I would advise that you:

- Do your homework

- Manage to the downside, the upside will take care of itself

- Use your resources or find them

A Few Resources

Here are a few books and tools that I used to help navigate the terms, considerations, and general understanding of getting into the real estate game:

- Investing in Real Estate – 7th Edition by Gary E. Eldred

- The McGraw Hill 36-Hour Course – Real Estate Investing – 2nd Edition by Jack Cummings

- BankRate.com – comparing mortgage interest rates and understanding the loan market

- Zillow.com – finding, valuing, and comparing homes

- Realtor.com – basically an extension of the MLS (multiple listing service)

- BiggerPockets.com – an awesome blog and community from which to learn

##

As an aside, I found real estate such an interesting topic that I decided to get my Real Estate Salesperson license in the State of Michigan. For less than $300 and three weeks of your life (~60 hrs total), I highly recommend it. Even just being a home-owner, I found the information invaluable.

Good write up, I see this home buying thing is working towards your best interests. I also like how you didn’t heavily stress the equity advantages of home sales; many Americans who purchased 5-10 years ago are learning that isn’t always the case. I have heard too many people say “My house is my biggest asset,” which is kind of like saying “youth is my best quality.” At some point, the party must end.

Obviously, stable residential markets tend to appreciate over time, but their rate of growth may or may not beat other conservative investments. It may not even exceed the rate of inflation. Plus the permanent nature of real estate exposes it to risks like demographic shifts, employers leaving town, ect.

In the end you have to live somewhere. A single-family residence should be personally considered as a liability (due to unfunded expenses), and any money you hopefully clear at a future sale should be considered a ‘windfall profit’ to your finances. Second mortgages on equity is generally a bad idea, though there are business-related exceptions. Renting is a good way to offset ‘holding costs’ if it works for your lifestyle.

Not just my opinion, Robert Kiyosaki (RDPD) agrees with my discussion. And for the readers at home – I am a full-time professional in real estate, so this topic is not exactly over my head.

Good points. I meant to give you a shout-out for being one of the few in our generation with the same mindset. You definitely helped to influence some of my decisions. It was good to see someone else doing what I was just beginning to consider. I read some of Robert Kiyoskai’s work and he too makes a lot of good points!

Yep, may have singlehandedly convinced me i need to stop putting it off and just buy already….money talks 🙂